Pradhan Mantri Jan Dhan Yojana (PMJDY): Among the various welfare schemes launched by the central government for the citizens, a notable one is the Pradhan Mantri Jan Dhan Yojana (PMJDY). This government scheme aims to provide financial services such as remittances, credit, insurance, pensions, savings, and easy access to savings accounts for the underprivileged and poor people of the country.

Individuals without a bank account can open an account here. There is no requirement to maintain a minimum balance. Additionally, in case of emergencies, this account offers an overdraft facility of up to ₹10,000. There are many other benefits as well. Let’s find out what advantages you can avail of with a Jan Dhan account from today’s report.

What is the Pradhan Mantri Jan Dhan Yojana? (PMJDY)

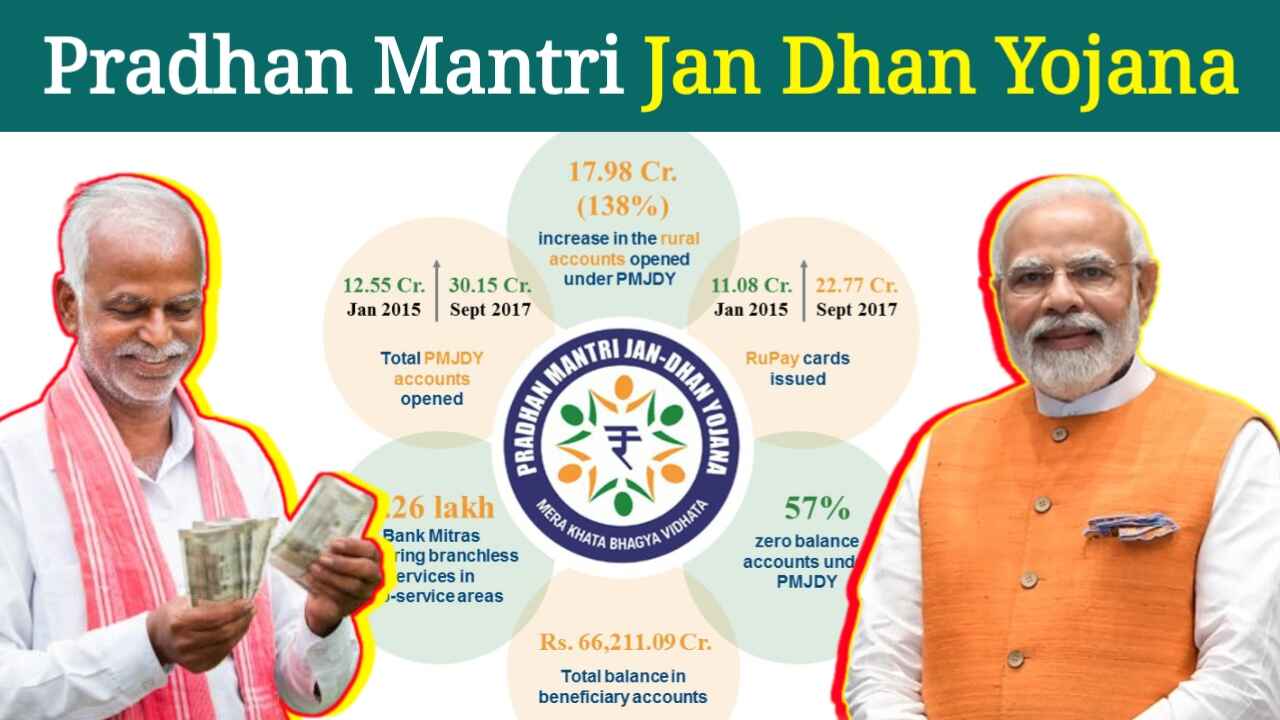

The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched by the Government of India to provide financial services to individuals without a bank account. The Modi government announced this scheme on August 15, 2014, with the objective that every individual in India should have a bank account. Accordingly, this project was launched on August 28. It is a zero-balance account. So far, over 520 million people have opened bank accounts under this scheme.

Under the PMJDY scheme, individuals can open a Basic Savings Bank Deposit Account (BSBD) in their name. The bank account can be opened at any bank in India or through bank mitra outlets. Individuals who do not already have a bank account can open a PMJDY account.

Read Also: PM Kisan Beneficiary List 2024: Village Wise List Check

What are the benefits of a PMJDY account?

With an account under the Pradhan Mantri Jan Dhan Yojana, numerous free benefits are available. The benefits are mentioned below:

- There is no need to maintain a minimum balance. The account will remain operational even with a zero balance.

- An account holder is provided with a RuPay debit card upon account opening.

- The account holder also receives an accident insurance coverage of up to ₹2 lakh.

- Interest will be earned on the deposited amount at compound interest rates.

- Loans can be availed based on the deposited amount.

- PMJDY account holders can avail an overdraft facility of up to ₹10,000 in case of emergencies.

Read More: PM Kisan Maandhan Yojana: Rs 3000 Pension for Farmers